If you're a salaried professional in India, chances are your employer offers a group Mediclaim policy. It’s a comforting thought — knowing your company has your back during medical emergencies.

But here’s the real question:

Is your group Mediclaim enough to truly protect you and your family?

Let’s unpack why depending solely on your employer’s health plan could leave you exposed, and why personal health insurance is more than just a smart backup — it’s a necessity.

A group Mediclaim policy is a health insurance plan purchased by your employer that typically covers you (and sometimes your family) during your tenure with the company. It usually includes:

- In-patient hospitalization

- Pre- and post-hospitalization (limited duration)

- Maternity cover (in some plans)

- Daycare procedures

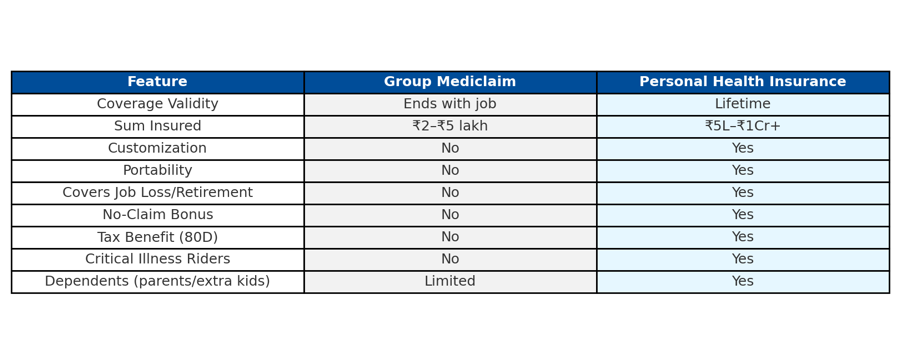

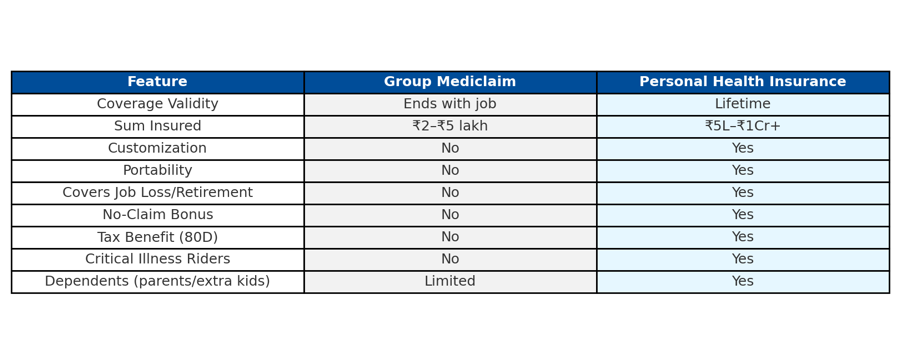

However, it often comes with limited coverage — usually in the range of ₹2 to ₹5 lakh — and little to no room for customization.

While group policies are great perks, they aren’t designed to be your only line of defense. Here’s why:

1. Tied to Your Job: Leave the job or retire, and your coverage vanishes.

2. No Portability: You can’t carry it over to a new employer.

3. Limited Coverage: High-cost treatments like cancer or organ transplants can easily exceed ₹5–₹10 lakh.

4. One-Size-Fits-All: You can’t tailor it to your specific needs or add riders.

5. Dependents May Be Left Out: Parents or more than one child may not be covered.

6. Not Future-Proof: Healthcare inflation is real — medical costs rise ~10–15% annually.

Why You Need a Personal Health Insurance Policy

A personal policy isn’t just a backup. It’s your core safety net. Here’s what it gives you that group Mediclaim doesn’t:

- Lifetime Portability: Your policy stays with you — no matter where you work.

- Customizable Coverage: You choose the sum insured, add-ons, and network hospitals.

- Higher Sums Insured: Covers major surgeries, critical illnesses, or prolonged hospitalization.

- Tax Benefits: Get deductions under Section 80D.

- Bonus for Staying Healthy: No-claim bonuses can increase your cover at no extra cost.

- Covers More: Add riders for maternity, mental health, OPD, and even wellness benefits.

How to Choose the Best Health Insurance Plan in India

- Adequate Sum Insured:

- Room Rent Flexibility:

- Short PED Waiting Period:

- Claim Settlement Ratio:

- Add-ons: Look for OPD, maternity, AYUSH, mental health cover.

💡

Pro Tip: Use tools like

Staywell’s PolicyBuilder to find the best-fit policy based on your age, city, and needs.

What’s the Smartest Strategy?

The ideal approach is to combine both:

- Use group Mediclaim for minor claims — save your personal policy for big bills.

-- Buy personal health insurance early — premiums are lower when you’re young and healthy, and there’s less risk of exclusions.

Real-World Scenarios:

- Rajeev, 45, was laid off during the pandemic. His group policy lapsed. When he tried to buy a personal plan, insurers loaded it with exclusions due to his borderline diabetes.

- Priya, 35, used her group cover for her maternity claim. But a post-delivery complication led to a bill of ₹7 lakh — her group cover maxed out at ₹3 lakh.

- Arun, 50, retired without a personal policy. He now struggles to find affordable coverage due to age-related conditions.

Don’t let that be your story.

Conclusion

Group Mediclaim is a bonus, not a backup plan. Relying solely on it is like walking a tightrope without a safety net.

A personal health insurance policy ensures that no matter your job, age, or future, you’re covered when it counts.