15 September 2025

Introduction

In a country like India, where healthcare expenses are rising sharply every year, having a health insurance plan is no longer a luxury — it's a necessity. This blog explains what health insurance means, how it works in India, and why it’s vital for every Indian household. We break it down in simple terms with examples and easy-to-follow tips.

What is Health Insurance and How Does It Work?

At its core, health insurance is an agreement between you and an insurer. You pay a premium regularly, and in return, the company covers some or all of your medical expenses. This can include hospitalization, surgeries, diagnostics, pre- and post-hospital care, and even outpatient consultations and mental health support in some plans.

Think of it as a financial safety net that protects your savings during unexpected medical events.

Why is Health Insurance Important in India in 2025?

1. Rising Medical Costs

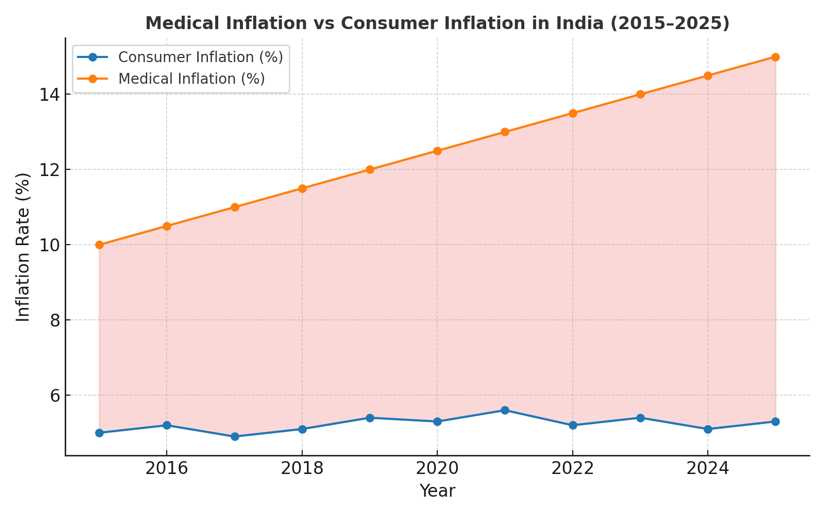

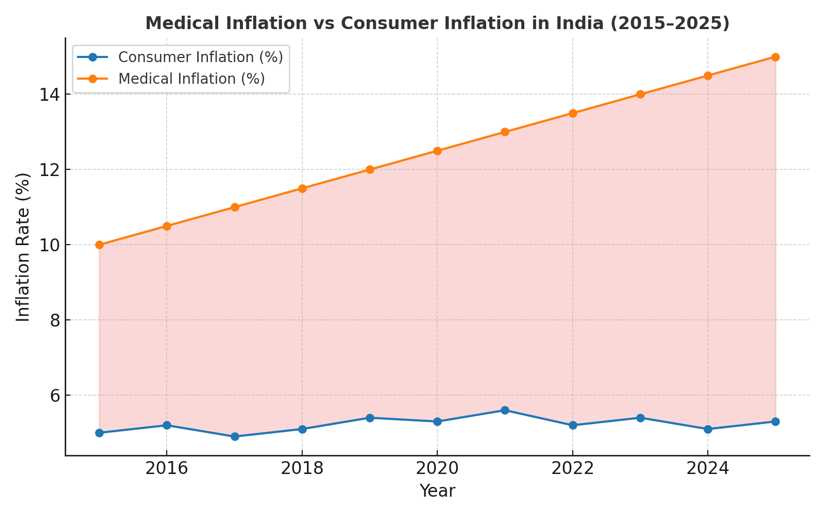

Healthcare inflation in India is growing at 10–12% annually — nearly double the rate of regular inflation. This makes even basic treatments in private hospitals unaffordable without insurance.

Healthcare inflation in India is growing at double the consumer inflation rate, making even basic treatments unaffordable without financial support.

2. Financial Security

2. Financial Security

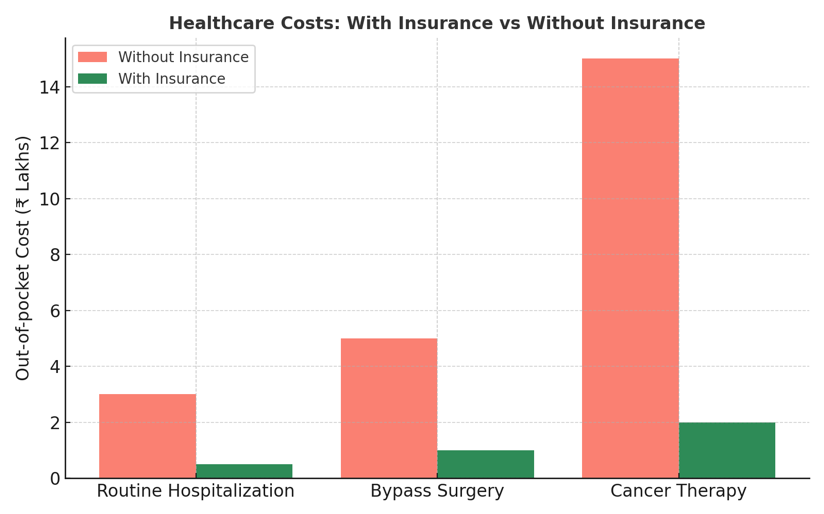

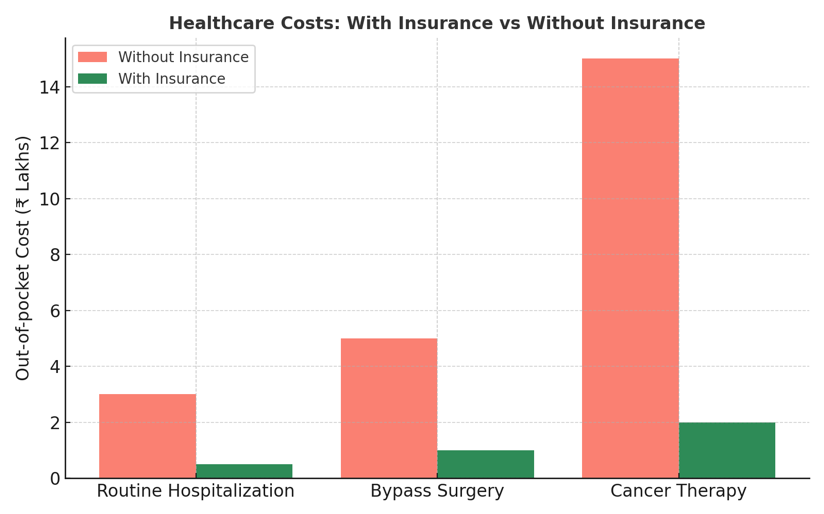

A single hospitalization can cost ₹1–5 lakh or more. A health plan ensures you don't dip into savings or go into debt.

A sudden hospitalization can cost lakhs. Health insurance prevents this from turning into a financial crisis.

3. Cashless Hospitalization

With a wide network of empanelled hospitals, many policies allow you to get treated without paying upfront. Just use your health card.

With a network of empanelled hospitals, you don’t need to pay upfront. Just show your health card and get treated.

4. Tax Benefits

Under Section 80D, premiums paid for health insurance are eligible for tax deductions up to ₹75,000.

Under Section 80D of the Income Tax Act, you can claim deductions of up to Rs 75,000 based on your family and senior citizen cover.

Real Stories That Show Why Health Insurance Matters

Example 1: Rajesh, 45, IT Professional (Bengaluru)

Rajesh’s father underwent a heart bypass surgery that cost ₹4.5 lakh. Thanks to his ₹10 lakh family floater health insurance, Rajesh only paid for incidental expenses.

“Without insurance, I would have dipped into my daughter’s education fund. Now, my savings are safe.”

Example 2: Anjali, 32, Entrepreneur (Delhi)

When Anjali was diagnosed with appendicitis, her hospitalization cost ₹1.8 lakh. Her policy covered the bill fully.

“I realized that health insurance in India is not just for older people. Even young professionals like me need it.”

Common Health Insurance Myths

"I’m young and healthy. I don’t need insurance."

Health emergencies are unpredictable. Buying early locks in low premiums.

"I have corporate health insurance."

It is not portable, and may not be enough. Consider a personal plan too.

How to Choose the Best Health Insurance Plan in India

Check Sum Insured: Choose a cover that matches medical costs in your city (Rs 10L+ is ideal in metros)

Room Rent Limits: Avoid plans with caps that restrict hospital room choices

Pre-existing Disease Waiting Period: Look for shorter waiting periods (2 years or less)

Claim Settlement Ratio: Choose insurers with high and consistent CSR

Add-ons & Features: Maternity, OPD, AYUSH, and mental health coverage are increasingly relevant

Try

Staywell’s free PolicyBuilder tool to find your best-fit policy.

📖 Also read: How to Choose the Best Health Insurance Cover in India in 2025

Why Are Healthcare Costs Rising So Fast in India?

Healthcare costs in India are rising at an alarming rate, and this affects how much coverage you really need. Here's why:

1. Medical Inflation: Healthcare inflation in India averages around 10–12% annually — double the consumer inflation rate. This means costs double every 7–8 years.

2. More Expensive Treatments: Robotic surgeries, imported implants, and modern therapies like immunotherapy and gene editing are significantly costlier.

3. Urban Lifestyles: Sedentary habits, pollution, and stress-related conditions have led to a spike in lifestyle diseases such as diabetes and hypertension.

4. Private Healthcare Boom: Over 70% of healthcare services in India are provided by private institutions that charge premium rates for quality care.

5. Longer Life Spans, Longer Treatments: Indians are living longer, but often with multiple chronic illnesses that require sustained and expensive care.

📌 Insight: A ₹5 lakh health cover today might fall short tomorrow. Re-evaluating your coverage every few years is not just wise — it’s essential.

Conclusion:

Health Insurance is not just important for you. It is critical for your financial security. Whether you’re buying your first plan or upgrading your cover, staying informed helps you make smarter decisions. Choose a policy that suits your healthcare needs and future risks — not just one with the lowest premium.

At

Staywell, we are India’s first AI-powered platform which helps you to compare and choose the right health insurance. Smart tools, transparent insights, and expert advice — all in one place.

Curious about other topics? Explore

our blog section on many more topics.

-

By:

By:

Staywell.Health