12 October 2025

Introduction

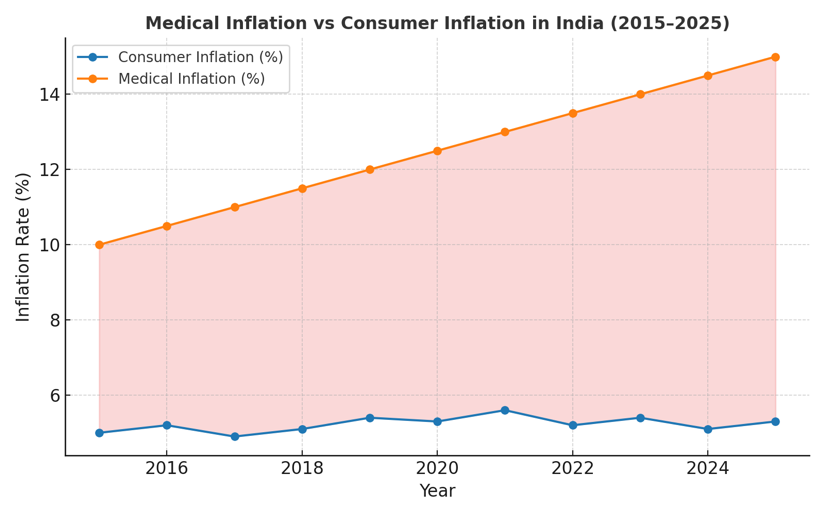

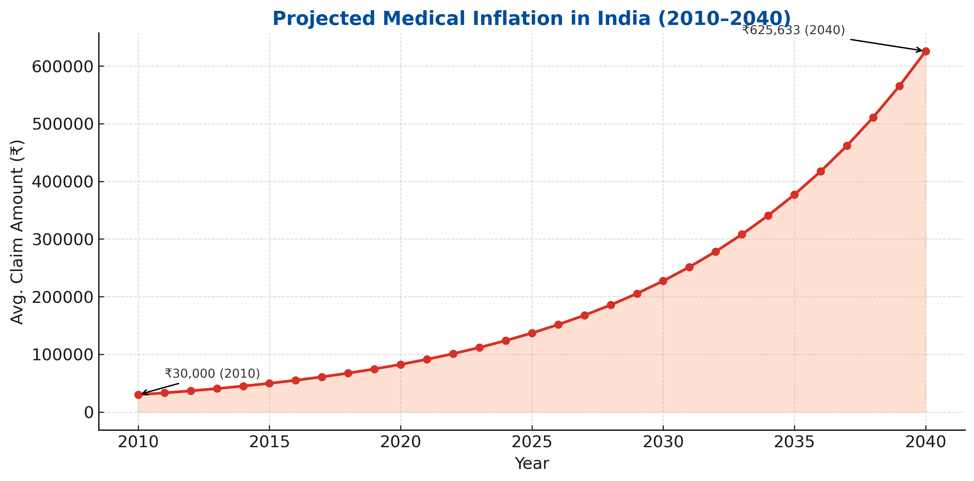

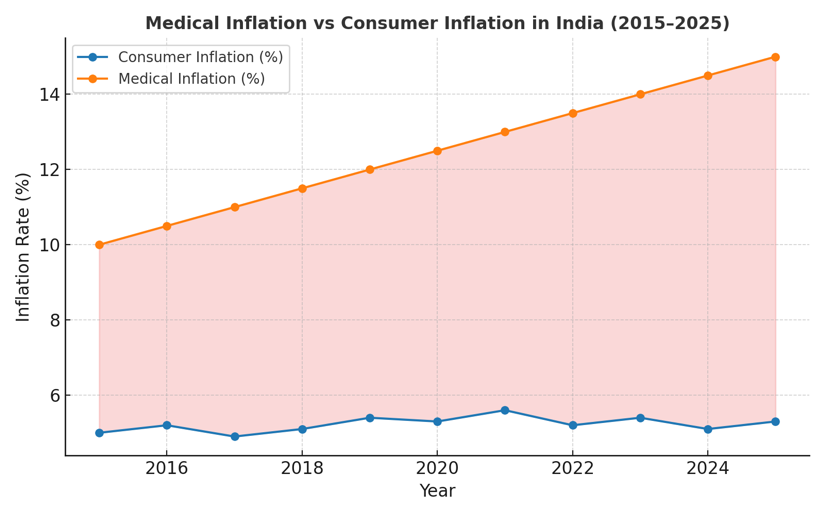

In India, healthcare costs are rising at an alarming pace. Medical inflation currently runs at 10–15% per year, far higher than overall consumer inflation. This means that what costs ₹5 lakh today could cost over ₹10 lakh in less than a decade. Routine hospitalization for common procedures such as gall bladder removal or orthopedic surgeries now falls in the ₹3–5 lakh range, while advanced treatments like organ transplants, cardiac bypass surgeries, or cancer care can easily touch ₹20–30 lakh. Without a robust health insurance plan, a single medical emergency can wipe out years of savings or force families into debt.

This makes one thing clear: the question is not whether you need health insurance, but how much is enough to safeguard your family’s future.

If you are wondering whether your health insurance policy is enough — you're not alone. Rising medical costs, unpredictable illnesses, and longer recovery times have made it critical to reassess what "enough" really means.

So, how much health insurance should you have in 2025 and beyond?

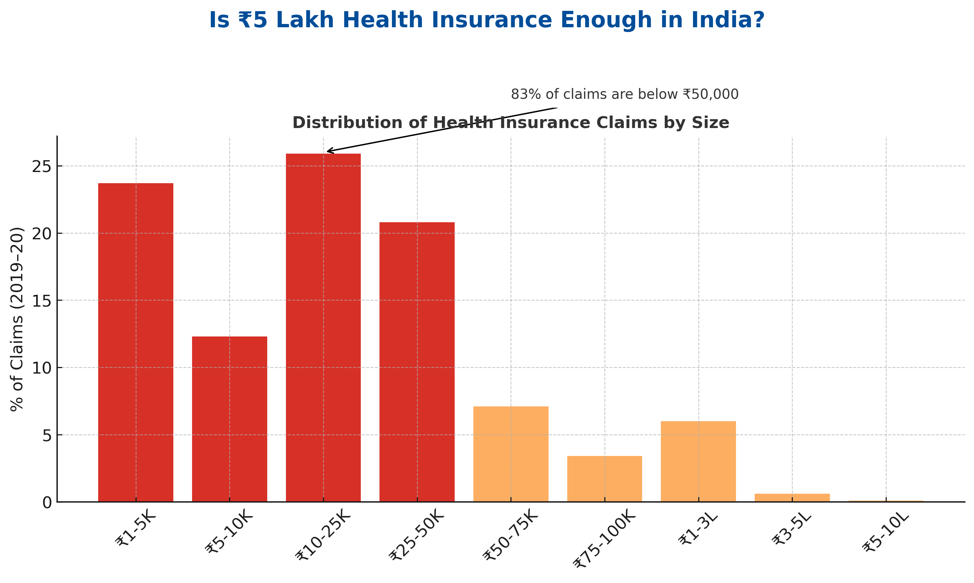

The ₹5 Lakh Illusion: Why It May No Longer Be Enough

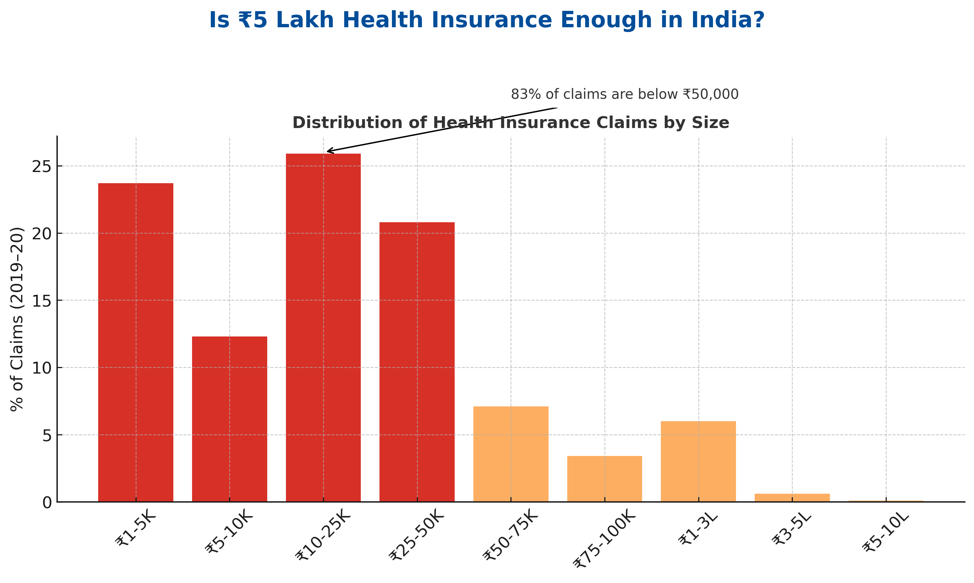

Most Indian families still default to ₹5 lakh as their health cover. But here’s what’s changed:

- Private hospital bills in Tier 1 cities often cross ₹10–15 lakh for critical illnesses like cancer or cardiac surgery.

- Medical inflation in India is ~10–12% annually, meaning costs double every 7–8 years.

- Even common surgeries — gallbladder, angioplasty, knee replacement — can cost ₹2.5 to ₹5 lakh in a single instance.

👉 Read:

Do I Need Personal Health Insurance If I Already Have a Group Mediclaim?

What Factors Should You Consider?

Key Factors That Determine the Required Coverage

1. City of Residence

Healthcare costs vary drastically by geography. In top-tier metros such as Mumbai, Delhi, or Bangalore, the cost of hospitalization is often 25–50% higher than in smaller towns. If you live in a metro or prefer treatment in multi-specialty hospitals, your required cover should be proportionately higher.

2. Family Size and Age Profile

A young nuclear family of three may find ₹10–20 lakh sufficient, but families with elderly parents or members over 50 should consider a cover of ₹25–50 lakh. Medical costs rise with age, and so does the likelihood of multiple hospitalizations.

3. Lifestyle and Risk Factors

The prevalence of lifestyle diseases in India is increasing. Diabetes, hypertension, and obesity are now common even among younger age groups. If your family has a history of such conditions, a higher cover is advisable.

4. Choice of Hospital and Quality of Care

Premium private hospitals with modern infrastructure often charge nearly twice as much as smaller hospitals. If you want the assurance of being treated in reputed hospitals without financial hesitation, opt for a higher sum insured.

The Smart Strategy: Combine Base + Top-Up Cover

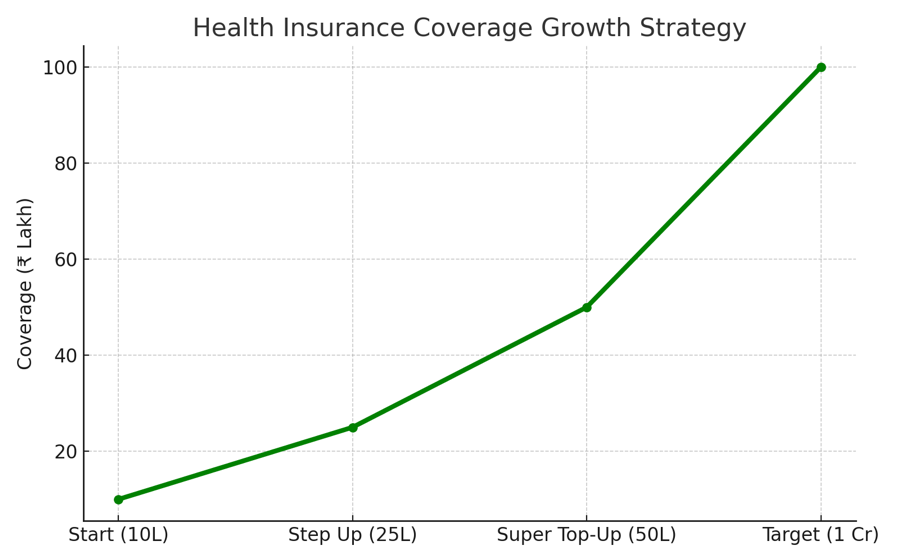

If a ₹20 lakh base policy feels too expensive, use this method:

Base Plan: ₹5 lakh

Super Top-Up: ₹20 lakh (deductible ₹5L)

Total Cover: ₹25 lakh

Premium Estimate: ₹9,000–₹14,000/year

4. Real-Life Examples

Ramesh, a 40-year-old professional from Gurgaon, bought a policy of ₹10 lakh a few years ago thinking it would be enough. When he underwent a major surgery costing ₹12 lakh, his insurance fell short, forcing him to dip into personal savings for the balance. That single episode set back his financial goals by several years.

On the other hand, Shalini, a 32-year-old from Bangalore, opted for a ₹25 lakh family floater policy. When her father-in-law needed a bypass surgery costing nearly ₹5 lakh and she had maternity-related expenses of about ₹3 lakh within the same year, her policy comfortably covered both without any financial strain.

Vivek, a 55-year-old Mumbai resident, relied on an older ₹5 lakh policy. When diagnosed with cancer, the treatment cost ₹18 lakh. Insurance covered just a fraction, and Vivek had to liquidate fixed deposits and even borrow from relatives. His story is a reminder of why under-insurance can be as risky as no insurance at all.

Key Insight: 83% of claims may be under ₹50,000 — but it’s the rare, high-ticket claims that can derail your finances.

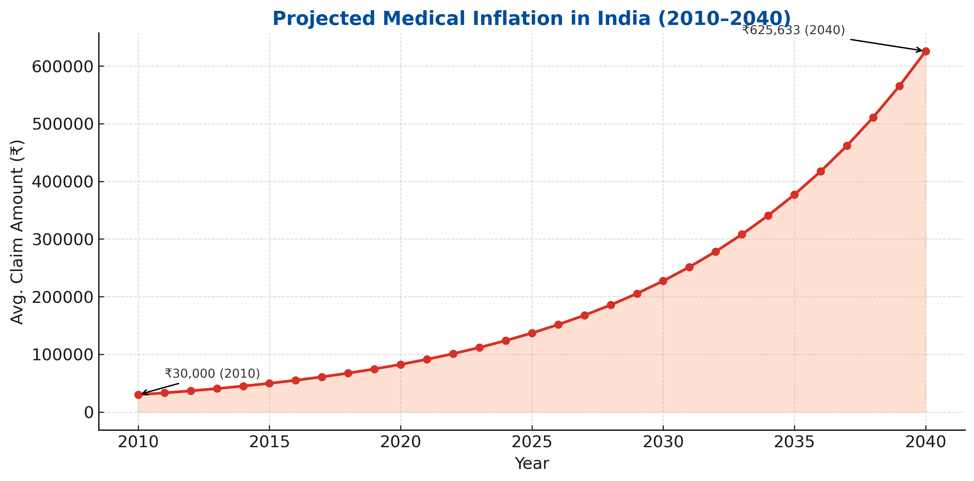

Insight: Inflation can be a killer! If average claims were ₹30,000 in 2010 and ₹1.37 lakh in 2025, they could cross ₹6.25 lakh by 2040.

How Much Health Insurance Is Enough? Practical Guidelines

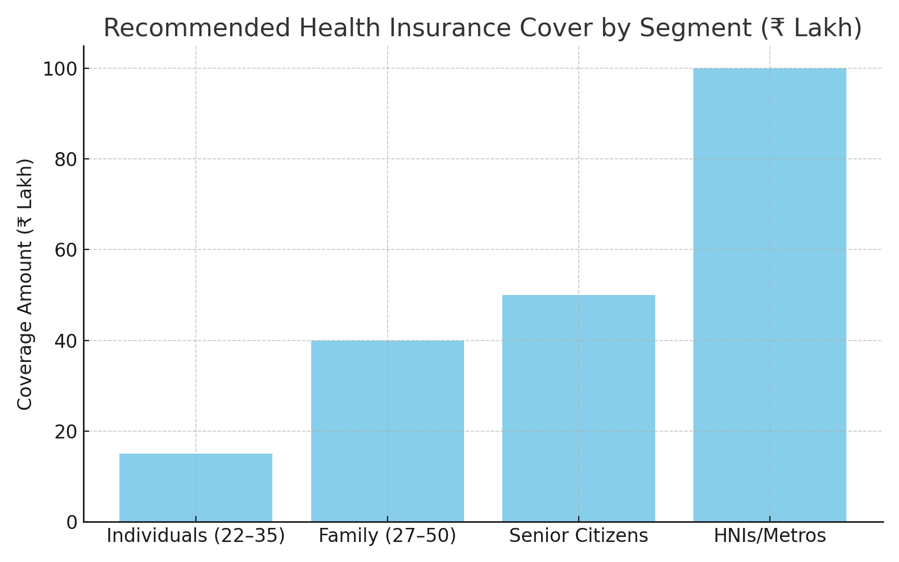

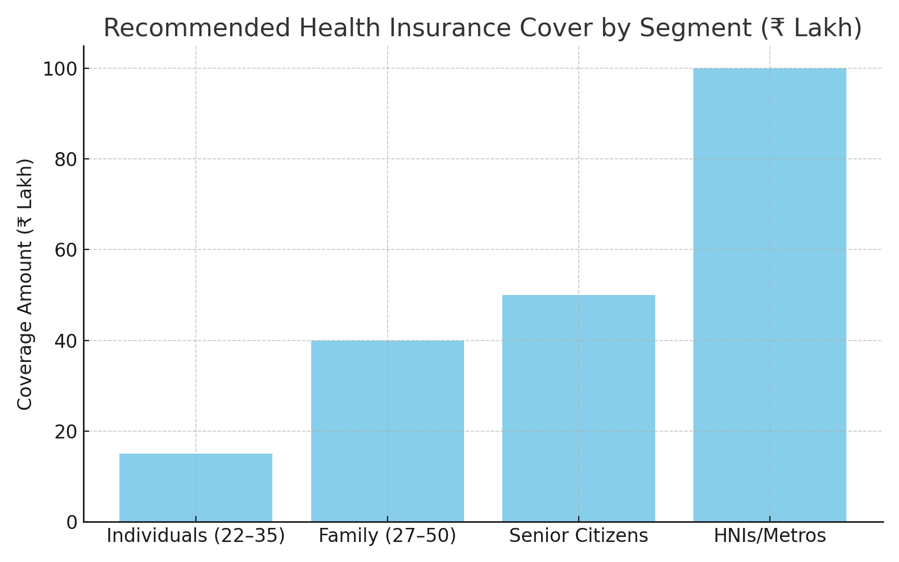

- Young individuals (22–35 years): Start with at least ₹10–20 lakh. Premiums are lower at this stage, making it easier to lock in higher cover.

- Family of 3–4 (27–50 years): A ₹25–50 lakh floater policy is advisable, as medical costs tend to compound with multiple dependents.

- Senior Citizens: Coverage should not be less than ₹25 lakh per person, and ideally ₹50 lakh as a family floater. The chances of multiple claims in a year are higher.

- High Net Worth Individuals or Metro Residents: With premium healthcare costs in urban centers, a ₹1 crore cover provides peace of mind.

Smart Strategies to Afford Higher Coverage

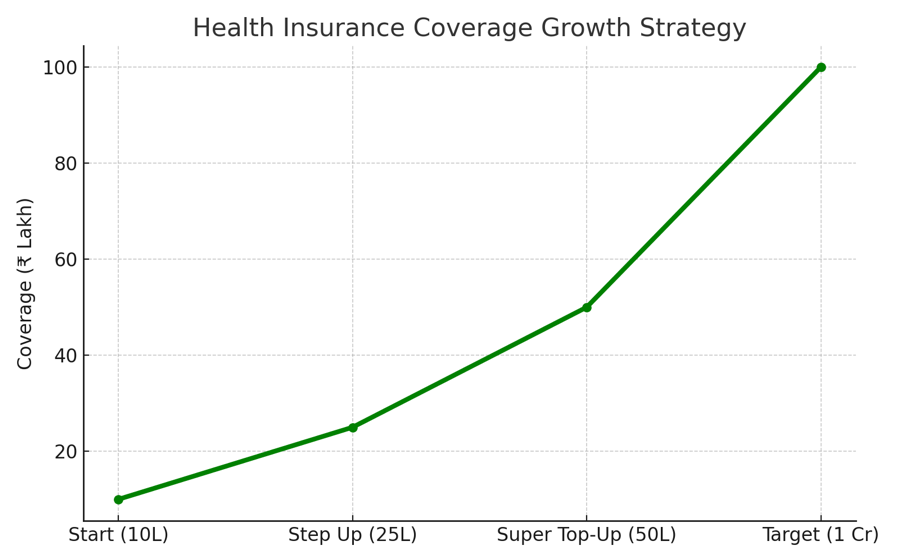

1. Base Policy + Super Top-Up: A simple way to afford a higher cover. For example, combine a ₹10 lakh base policy with a ₹40 lakh super top-up. This brings your effective cover to ₹50 lakh at a fraction of the premium cost.

2. Plans with In-Built Growth Benefits: Some policies double or triple the sum insured if there are no claims over consecutive years. This is particularly useful for young families.

3. Unlimited Restoration Add-Ons: These add-ons refresh your cover even after it is used, ensuring multiple hospitalizations within a year are covered.

4. Phased Increase in Coverage: Instead of buying the maximum cover upfront, increase your sum insured gradually as your income grows. This makes it affordable without compromising on future readiness

Conclusion

In today’s healthcare environment, ₹5 lakh is no longer enough. Whether you're young, have a family, or supporting aging parents — a ₹20–25 lakh cover is fast becoming the new normal.

Choose wisely. Because health insurance isn't about saving on premium — it’s about avoiding financial catastrophe when life throws a curveball.

-

By:

By:

Staywell Health