20 September 2025

Choosing the right health insurance cover can feel overwhelming. A staggering number of plans—each with different features, terms, and pricing—can leave even seasoned buyers confused. One wrong choice and you risk paying out-of-pocket for treatments you thought were covered. In this guide, we simplify the process, share key decision points, and introduce PolicyBuilder, Staywell’s proprietary tool for precision-fit cover selection.

Why It’s So Confusing: The Multiplicity of Plans

India’s health-insurance ecosystem is vast:

- Individual vs. family floater

- Sum insured: ₹1 lakh to ₹1 crore

- Deductibles & co-payments

- Add-ons: Critical illness, maternity, OPD, etc.

- Network hospitals

It’s no wonder gems like pre-existing-disease coverage or daycare treatments can slip through the cracks. Choosing the wrong policy isn’t just inconvenient—it can be painful and expensive.

The Risks of the Wrong Policy

What happens if you choose wrongly?

- Unexpected out‑of‑pocket expenses

- Denied or reduced claim settlements

- Policy lapse due to overlooked waiting periods

- Limited coverage when treated outside the network

For example, someone buying a low-cost policy might later realize that it doesn’t cover diabetes-related complications. Learn more in our article on Best Health Insurance for Diabetics in India.

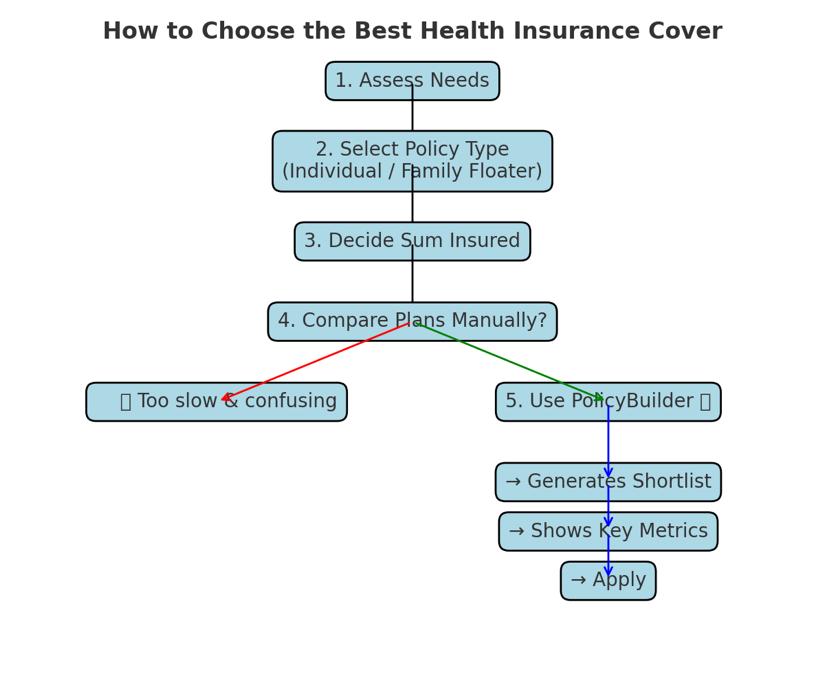

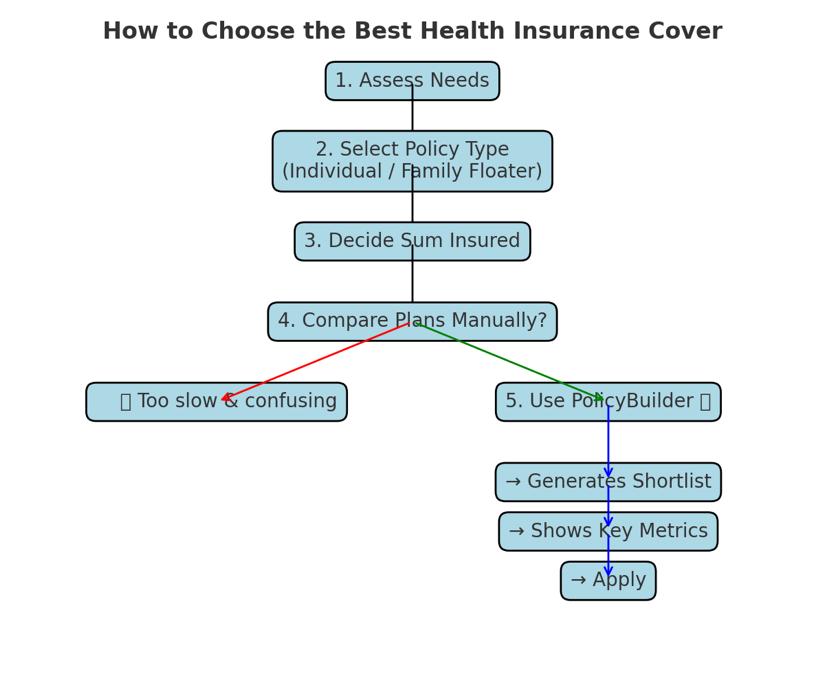

How to Choose the Right Cover: A Step-by-Step Approach

a) Assess your needs & risks

- Who needs covering?

- Any pre-existing conditions?

a)Age of applicants

b) Decide on policy type & sum insured

- Family floater vs individual

- Start with at least ₹5–10 lakh

c) Understand inclusions & exclusions

- Daycare, pre/post hospitalization

- Waiting period for PED

d) Compare add-ons vs base plans

e) Evaluate insurer network hospitals

f) Check clarity in policy terms

Enter PolicyBuilder: Staywell’s Game-Changer

We get it—manual comparisons are tedious. That's why

Staywell built PolicyBuilder, a pathbreaking proprietary tool that:

When you’re buying health insurance for the first time (or upgrading), choice overload can lead to bad decisions.

PolicyBuilder helps new customers by:

- Asking 8–10 simple questions (age, city, family size, conditions).

- Automating comparison of 100+ policies.

- Creating a shortlist of 1/3 best-fit policies.

- Flagging hidden fine print (PED waiting, room rent caps, co-pays).

- Saving lots of research time.

What Using PolicyBuilder Looks Like

1. Enter your basic info

2. Answer preferences

3. Get a top plan shortlist

4. Compare detailed policy breakdowns

5. Apply online

Visit

Policy Builder to try it now.

Already have a policy? Don’t know if it’s enough? That’s where

PolicyAnalyser comes in.

PolicyAnalyser helps existing customers by:

- Reviewing your current plan’s adequacy.

- Scoring it on 47+ parameters (coverage, PED terms, portability, exclusions).

- Flagging risks like “₹5 lakh too low in metros” or “no mental health coverage.”

- Suggesting whether to retain, upgrade, or switch.

👉

Best For: Existing customers who want to validate if their current policy protects them adequately — or if it’s time to upgrade.

What Using PolicyAnalyser Looks Like

1. Enter your basic info

2. Enter your current health insurance plan

3. Get a detailed comparison of your plan versus our recommended plans

5. Apply online

Final Takeaways

- Indian health‑insurance plans are numerous and complex

- Use a systematic process: assess, compare, apply

- PolicyBuilder and PolicyAnalyser tools help to remove confusion and risk

-

By:

By:

Staywell.Health