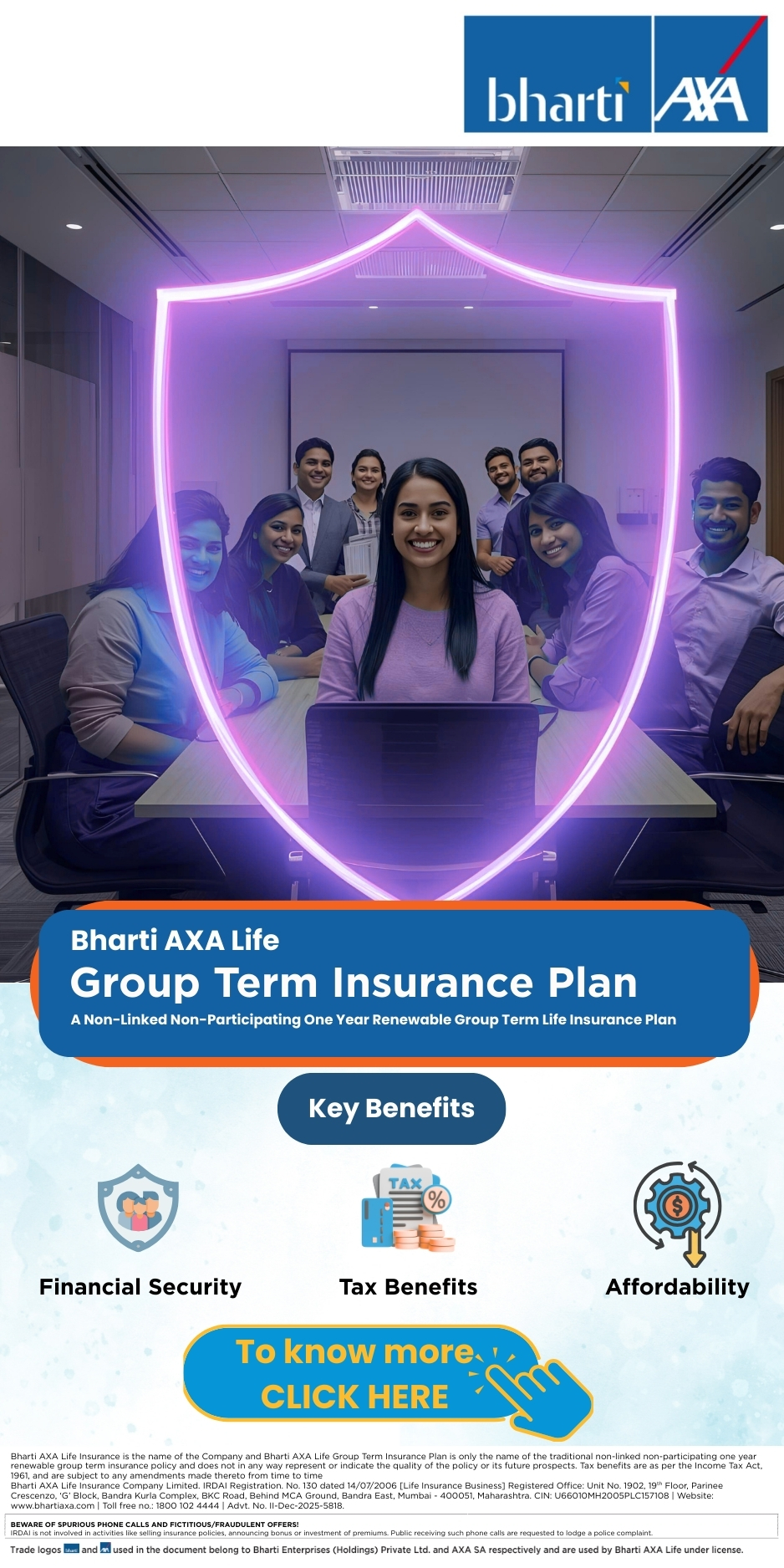

Why Health Insurance for Senior Citizen Is Important

Senior citizens are more vulnerable to illnesses such as heart disease, diabetes, arthritis, respiratory issues, and age-related complications. Even a short hospital stay can cost lakhs in metro cities.

Here’s why

Health insurance for senior citizen is no longer optional:

- Higher risk of hospitalisation with age

- Rising healthcare costs across India

- Limited or no employer medical coverage after retirement

- Need for regular check-ups and follow-up treatments

- Financial independence and peace of mind

With the right

Health insurance for senior citizen, medical emergencies don’t turn into financial crises.

What Is Health Insurance for Senior Citizen?

Health insurance for senior citizen is a specially designed medical insurance policy for individuals typically aged 60 years and above. These plans offer coverage for hospitalisation, treatments, and age-related illnesses while considering the unique healthcare needs of elderly individuals.

Unlike regular plans,

Health insurance for senior citizen focuses on higher coverage for chronic illnesses, frequent medical care, and easier claim processes.

Who Should Buy Health Insurance for Senior Citizen?

Health insurance for senior citizen is ideal for:

- Retired individuals above 60 years

- Parents without employer-provided insurance

- Senior citizens with pre-existing conditions

- Families looking to financially protect ageing parents

- Individuals seeking independence in healthcare decisions

Whether purchased individually or by family members,

Health insurance for senior citizen ensures continuous medical coverage.

Key Benefits of Health Insurance for Senior Citizen

1. Financial Protection from High Medical Costs

Healthcare expenses rise sharply with age.

Health insurance for senior citizen protects retirement savings from unexpected hospital bills.

2. Coverage for Age-Related Illnesses

Most

Health insurance for senior citizen plans cover conditions like diabetes, blood pressure, heart ailments, and joint-related issues after waiting periods.

3. Cashless Hospitalisation

Access cashless treatment at network hospitals, reducing stress during emergencies.

4. Peace of Mind for Families

Children and caregivers feel assured knowing their parents are covered under

Health insurance for senior citizen.

What Does Health Insurance for Senior Citizen Cover?

A comprehensive

Health insurance for senior citizen policy generally includes:

- In-patient hospitalisation expenses

- ICU and room rent charges

- Pre-hospitalisation and post-hospitalisation costs

- Diagnostic tests and medicines

- Ambulance expenses

- Daycare procedures

- Some plans also include domiciliary treatment

These benefits ensure seniors receive proper care without financial worry.

Understanding Medical Insurance for Senior Citizens

Medical Insurance for senior citizens is designed to address the higher medical needs of elderly individuals. These plans usually come with tailored benefits such as higher coverage for chronic illnesses, regular health check-ups, and simplified claim procedures.

Choosing the right

Medical Insurance for senior citizens ensures continuity of care even in advanced age.

Mediclaim for Senior Citizens – How It Helps

A

Mediclaim for senior citizens policy reimburses or settles hospitalisation expenses incurred due to illness or accidents. These plans focus on providing structured coverage for medical costs that seniors are most likely to face.

Having a reliable

Mediclaim for senior citizens reduces dependency on personal savings and ensures dignified healthcare.

Best Health Insurance Plan for Senior Citizens – What to Look For

Choosing the

best health insurance plan for senior citizens requires careful evaluation. Here are key factors to consider:

- Entry age and lifelong renewability

- Waiting period for pre-existing diseases

- Coverage limits suitable for metro cities

- Network hospitals near residence

- Simple and transparent claim settlement

The

best health insurance plan for senior citizens balances affordability with comprehensive coverage.

Health Insurance for Senior Citizen with Pre-Existing Diseases

Most seniors have pre-existing conditions. A good

Health insurance for senior citizen offers coverage for such conditions after a defined waiting period.

Whether it’s diabetes, hypertension, or heart disease,

Health insurance for senior citizen ensures long-term financial protection once the waiting period is completed.

Individual vs Family Coverage for Senior Citizens

Some families include elderly parents under a broader plan, while others prefer separate coverage. While

Family health insurance may work in some cases, a dedicated

Health insurance for senior citizen often provides better benefits and fewer restrictions for elderly members.

Choosing the right structure depends on age, health condition, and budget.

Health Insurance for Senior Citizen in Metro Cities

Healthcare costs are significantly higher in metros. For example, treatment expenses covered under

health insurance in Mumbai can be similar to those in Delhi, Bengaluru, or Chennai.

A well-chosen

Health insurance for senior citizen with adequate sum insured is essential for urban healthcare needs.

Health Insurance for Senior Citizen and Critical Illness Coverage

Some senior citizen plans also offer optional riders for serious illnesses. While specialised coverage like

health insurance for Cancer exists separately, having additional protection within a

Health insurance for senior citizen plan adds an extra layer of security.

How to Buy Health Insurance for Senior Citizen Online

Buying

Health insurance for senior citizen online is simple and transparent:

- Compare plans based on coverage and premium

- Check entry age and waiting periods

- Select suitable sum insured

- Complete online application

- Get policy confirmation instantly

Online comparison helps seniors and families make informed decisions.

Claim Process for Health Insurance for Senior Citizen

Cashless Claims

Visit a network hospital and present the

Health insurance for senior citizen policy details. The insurer settles eligible bills directly.

Reimbursement Claims

Submit medical bills and documents for reimbursement as per policy terms.

A smooth claim process is crucial for elderly policyholders.

Common Myths About Health Insurance for Senior Citizen

Myth 1: Senior citizens cannot get health insurance

Fact: Many insurers offer dedicated

Health insurance for senior citizen plans.

Myth 2: Premiums are unaffordable

Fact: Plans are available at different price points depending on coverage.

Myth 3: Claims are difficult

Fact: With the right insurer and advisor, claims can be smooth and transparent.

Why Choose Staywell for Health Insurance for Senior Citizen?

Selecting the right advisor matters, especially for elderly policyholders.

Staywell.health helps individuals and families compare, understand, and choose the most suitable

Health insurance for senior citizen plans based on health condition, age, and budget.

With expert guidance from

Staywell.health, seniors receive personalised support and hassle-free assistance throughout the policy journey.

Secure a Healthy and Independent Future

Ageing should be about comfort, dignity, and peace—not financial stress. A well-chosen

Health insurance for senior citizen ensures access to quality healthcare without worrying about rising medical expenses.

Plan today to protect yourself or your loved ones with the right

Health insurance for senior citizen, and enjoy your golden years with confidence and security.